INVESTMENT PORTAL

The Math

Works.

A Roll-Up that reprices years of operational excellence through deliberate scaling and public-market access.

The Strategy

Acquire convenience store operations at private-market multiples

Invest in targeted modernization

Standardize systems where it helps

Preserve local character where it matters

Scale deliberately toward public-market access

The Multiple Expansion

Private Market

~3.1x–5x EBITDA

Public Comps

Underperforming

~9.8x

Established

up to ~38x

QuickTime Targets

Initial

15x EBITDA

Longer Term

30x EBITDA

Value Creation (Example)

Initial Phase

Acquire at:

$6.28M

Renovation:

$0.7M

Total Invested:

$6.98M

At 15x EBITDA

$30M

Valuation

At 30x + Operational Lift

$78M

Valuation

Execution Driven

Upside driven by execution, not leverage. Our model reprices years of operational excellence.

Liquidity Advantage

No personal guarantees

Shares can be borrowed against

Public equity ≠ locked capital

Partial exits possible

Liquidity becomes tactical, not existential.

Detailed Financials

Access the complete math behind the roll-up strategy and acquisition pipeline.

Download Offering Circular

A Stellr Power Corporation Company

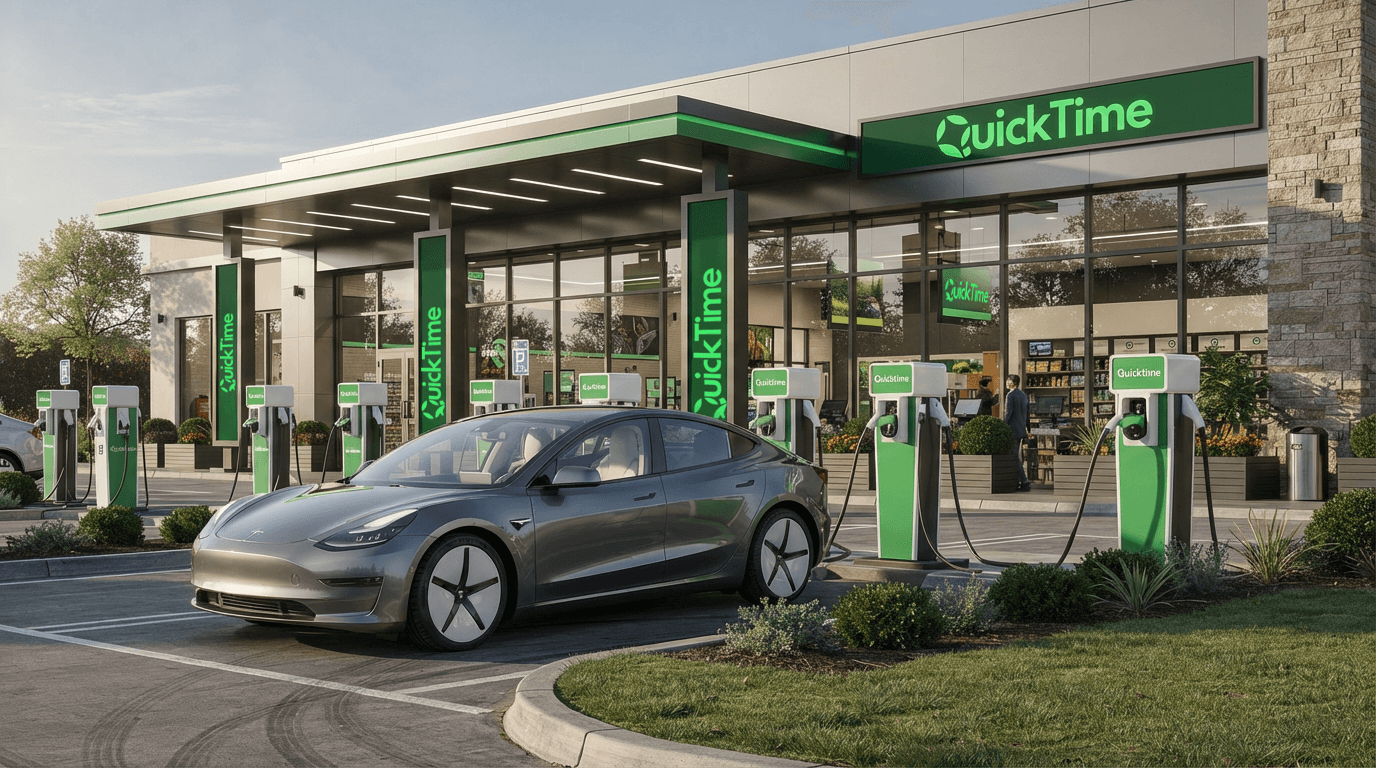

The next wave of the convenience store experience. Improving neighborhoods and customer experiences with newly renovated stores.

Explore

Contact

Mesa, AZ

85205

info@qtconvenience.com

(602) 598-0748

© 2026 QuickTime Convenience Stores. A Stellr Power Corporation Company.